There is tons of cryptocurrency information on the internet, enough to overwhelm professional cryptocurrency dealers and newcomers alike. However, if you are looking for a detailed guide on how to trade cryptocurrencies, you are at the right place. To lift the burden of information overload, we focus on the most important aspects of cryptocurrency trading. We made this guide simple yet well-detailed.

What is cryptocurrency?

A cryptocurrency is a form of virtual or digital currency secured by cryptography. Several cryptocurrencies are on a decentralized network established using the blockchain technology. Blockchain is a distributed ledger maintained by distant connections of different computers. A special trait of cryptocurrencies is the fact they are not issued by or under the control of any central authority. This makes it impossible for governments to manipulate or meddle with them.

In this guide, you will learn everything you need to start your cryptocurrency trading journey. Whether you are looking to start or broaden your knowledge in the cryptocurrency sphere, this guide will enable you to buy and sell cryptocurrencies the right way. So let’s dive in.

In simpler terms, cryptocurrency is virtual money that you can’t see, touch, or feel. We use money for purchases or when paying for different services. Cryptocurrencies retain these attributes and more.

Cryptocurrency deals are borderless. It means that you can send this form of electronic money anywhere in the world as long as both parties involved in the transaction have a cryptocurrency wallet. We will come to what a cryptocurrency wallet is in the latter part of this guide.

Cryptocurrency gives you the fiscal power to enjoy your own money and manage yourself without interference from third parties like governments or central banks. No one has access to your finances except you alone.

Blockchains, which are organizational technologies for preserving the integrity of transactional data, are an essential element of numerous cryptocurrencies.

Cryptocurrencies are digital money established on a network connected across distant computers. The decentralized nature of crypto assets means that centralized authorities or the government have little control over this market.

The word “cryptocurrency” is derived from the process of encryption which is used to protect the network.

Cryptocurrencies can be used to make secure payments online, and transactions are represented by ledger entries, denominated in terms of tokens. The word “crypto” defines the various cryptographic techniques and encryption algorithms used to safeguard entries such as public-private key pairs, elliptical curve encryption, and hashing functions.

Examples of Cryptocurrency

The first cryptocurrency to use the blockchain technology was Bitcoin, which is still the virtual asset with the highest value and a market share of over 64.3% in April 2025, according to TradingView. Thousands of alternative cryptocurrencies, commonly referred to as altcoins, have emerged after the launch of Bitcoin in 2009, each with a different function and application. While the cryptocurrency landscape saw a peak of digital coins in early 2022, by 2023, the number stood at around 9,000.

It is important to recognize that the vast majority of these have limited impact, with estimates suggesting up to 20,000 digital coins have been launched, but many are now inactive. The reality is that 20 or so cryptocurrencies dominate the market, accounting for approximately 90% of its total value. The ease of creating new cryptocurrencies contributes to this large, yet often insignificant, long tail.

Below, you can see the most commonly traded cryptocurrencies.

| Currency | Symbol | Launch Date | Market Cap (April 24, 2025) |

|---|---|---|---|

| Bitcoin | BTC | 2009 | $1.84 trillion |

| Ethereum | ETH | 2015 | $214.02 billion |

| Binance Coin | BNB | 2017 | $85.3 billion |

| Cardano | ADA | 2017 | $24.23 billion |

| Tether USD | USDT | 2014 | $145.68 billion |

| Ripple | XRP | 2012 | $125.69 billion |

| Dogecoin | DOGE | 2013 | $25.84 billion |

Cryptocurrency designation: money or security?

While many consider cryptocurrencies to be a form of money, the U.S. Internal Revenue Service (IRS) classifies them as fiscal securities or assets. This means that if you profit from investing or trading in cryptocurrencies, the government will tax your earnings. In a proposal submitted by the United States Department of Treasury, it was announced that taxpayers are to report transactions of $10k and above to the Internal Revenue Service. The tax rate and the type of tax applied to crypto profits depends on the duration of the holding pediod and the type of service US traders have initiated in the crypto market.

Origin of Bitcoin

What is known today as Bitcoin was created in 2008 by an individual or group of individuals known under the pseudonym “Satoshi Nakamoto.” However, the currency came into use in 2009 when its implementation was released as open-source software. Since then, bitcoins are created through a process known as mining.

There are about 19.86 million bitcoins in circulation, with a market capitalization of approximately $1.84 trillion as of April 24, 2025. However, it should be noted that this figure changes frequently as it is dependent on various market conditions. The maximum number of bitcoins that can be mined is capped at 21 million. This cryptocurrency is considered extremely secure because the limited supply prevents manipulation.

Bitcoin is just one of the numerous cryptocurrencies in the world, but it is, by far, the leading one. After the launch of Bitcoin in 2009, coins like Litecoin, Cardano, EOS, IOTX, DENT, Ethereum, and many more came to be. The collective name for the virtual coins that came into existence after Bitcoin is “altcoins”. The total value of all virtual coins was estimated to be over $2.88 trillion in April 2024, with Bitcoin dominating the market with a 64.3% share.

Bitcoin is the first cryptocurrency created by an individual or group of individuals hiding under the pseudonym “Satoshi Nakamoto.” Any coin that is not Bitcoin is regarded as an “altcoin”, short for “alternative coin”.

Common cryptocurrency terms

Like other financial markets, the crypto sector has its own lingo that traders who engage in crypto analysis and investments utilize. To be able to participate in cryptocurrency discussions and analysis, you must get familiar with the terms we have provided below:

ATH & ATL

“ATH” stands for All-Time High. When a particular asset reaches a new record price that has not been reached before, then we can say that that asset has made a new ATH. Knowing the ATH of digital currencies can prove valuable as this would allow you to avoid buying the asset at a higher price or buying near the ATH. The opposite of this is “ATL” which means “All Time Low”. When an asset reaches the lowest price in its history then we say that asset is trading at its ATL.

Bear/Bearish

If you have a bearish bias towards an asset, you believe that the price of that asset will decline. When your sentiment is bearish, you take a short position in the market with the hope of making some profits when the price falls. A person with a bearish sentiment in the market is called a bear.

Blockchain

Blockchain is a digital register that is made up of a series of blocks, with each block containing verified trades. This type of network was designed to be decentralized and immutable – meaning that no one can delete or distort a transaction once it is registered in the blocks. The concept of blockchain came to be in 2008 after the release of Bitcoin’s whitepaper.

Distributed Ledger

A distributed ledger is a register containing information that has been distributed or shared across different devices. An example of this is the blockchain which was developed to track all the transactions of Bitcoin.

P2P

This is an abbreviation of peer-to-peer, which is a type of service where two people handle their transactions directly without a third party or intermediary meddling with the process. In this case, a buyer and a seller deal directly through the P2P service.

Escrow

An escrow is a middleman or third party that holds money on behalf of another party. This usually happens when two parties who do not trust each other want to execute a transaction. One person transfers the funds to an escrow who then passes them on to a counterparty once a specific obligation has been fulfilled by the other party.

Fiat Currencies

Fiat currencies are physical currencies that are issued by the government. Thus, they are usually centralized, minted, and printed. Examples of these are the United States dollar, the Japanese yen, and the British pound.

Exchanges

Exchanges are platforms where you can buy and sell cryptocurrencies. They are the marketplace for buyers and sellers to interact with one another and trade different digital assets. Crypto exchanges are the fastest way to buy and sell cryptocurrencies.

FOMO

“FOMO” means the “fear of missing out.” This is a situation whereby investors and traders start buying an asset because they have seen or heard (usually through rumors and hype created online) that the price of an asset will increase. This is almost similar to panic buying because you do not want to miss out on the news or whatever forces are driving the price of that asset up. However, trading in this way can hurt your portfolio as most of the time you may be buying into a manipulated market.

Fork

A fork is the alteration of digital assets protocols or rules. This happens when the developers update the asset rules. We can distinguish between soft and hard forks. A hard fork represents an asset’s protocol change that prevents the old protocol from working and, as a result, creates a new one. Simply put, a hard fork is a permanent transition from an old ecosystem to a new one. On the other hand, a soft fork is backwards-compatible because old nodes will recognize the new blocks as valid.

FUD

“FUD” stands for “Fear, Uncertainty, and Doubt.” This usually happens when market participants start spreading inaccurate and misleading information about a particular asset for the sole purpose of causing the price to dip, and then profiting by buying at a lower price.

HODL

“HODL” is not a misspelled word but it was coined by traders, meaning “Hold On for Dear Life.” A trader who’s hodling will usually avoid selling his assets during volatile market periods and will hold on to them in hopes that the price will reverse or move further in his favor.

Initial Coin Offering

Initial Coin Offering or an ICO is a situation whereby a coin is being listed on an exchange so that the public can buy and sell it at will. It is a means to raise capital, just like when a company offers shares to the public when they decide to go public.

KYC

Know Your Customer, or KYC, is a method used by exchanges to verify the identity of their clients. This is a customer protection measure that was enforced by a number of regulatory bodies to prevent money laundering, terrorist financing, and other illegal activities.

Long/Long Position

When you take a long position or you go long in a market, it means that you expect prices to rise in value. If you are long on Ethereum, for example, it means you bought the crypto with the hope that it appreciates.

Short/Shorting

When you short an asset, it means you expect or anticipate a drop in the price of that asset. Shorting can either be by directly selling the asset or buying a put option. Selling/Shorting an asset is a risky method of trading considering the volatile nature of the market.

Market Cap

Market cap, or market capitalization, refers to the total market value of an asset. For example, the market cap of Bitcoin is the product of the total number of outstanding bitcoins in circulation and the current market price. As such market conditions are constantly changing, so does the market cap of a cryptocurrency.

POS

Proof of Stake or “POS” is a method of verifying transactions. Cryptocurrencies that use this method to verify transactions often distribute all their tokens in advance, and the miners are selected based on their contributions, (the amount they have staked). Stakeholders usually receive rewards in the form of transaction fees. Popular altcoins like Cardano, Ethereum, and Solana all use POS as their consensus mechanisms.

POW

Proof of Work or “POW” for short is a way to show that a digital asset’s transaction has been confirmed. Bitcoin and many other cryptos use Proof of Work. Bitcoin, Litecoin, and Dogecoin use Proof of Work for transaction verification on their blockchains. While miners do most of the work with this consensus mechanism, they are rewarded with a fraction of the assets under verification.

Noob

If you’re new to trading or cryptocurrency, you will be referred to as a noob. It is a short way of saying “newbie.” Noobs have to learn how the market works before they get involved in this volatile market.

Moon/Mooning

The word “moon” or “mooning” means that an asset has risen rapidly in value. For example, you could say that Dogecoin is going to the moon when its price rises sharply.

Mining Incentive

Mining incentives are given to miners who confirm transactions and mine those transactions into blocks. For instance, people who partake in mining Bitcoin have to buy special hardware and pay huge electricity bills, it only makes sense they receive some form of token for this tedious work – see it as their wage for working.

Rekt

When you lose a substantial amount of money because of holding an asset, you are said to have rekt – a slang for wrecked.

ROI

ROI means Return on Investment. It simply tells you how much profit you have realized from your investment in a cryptocurrency. This can either be positive or negative.

Pump and Dump

Pump and dump is a form of market manipulation where traders or investors come together to influence the price of an asset so that they will sell it when the price is high. They do this by creating a false activity in the market which ignorant investors buy into, causing the price to pump. After pumping the price, they will dump (sell) the asset on profit while leaving ignorant traders with the bag (worthless coins). You have to pay attention not to get caught in a pump-and-dump scheme.

Token

Units of digital assets with their own blockchain are typically called coins (like Bitcoin, ADA, and BNB), while digital assets built on existing blockchains are known as tokens, many of which serve specific purposes.

Whale

A whale is a person who trades or controls a large volume of cryptocurrencies. Whales have been known to inflate or manipulate the price of digital currencies. It is usually given a metaphorical description as making waves in the ocean.

White Paper

White papers are documents that contain comprehensive information about a digital asset together with its underlying technology or ecosystem. This document helps traders or investors to understand how that particular asset works and its uses.

Some benefits and shortcomings of cryptocurrencies

As with most things in life, cryptocurrencies come with a lot of benefits, as well as some demerits. We outline their main advantages and disadvantages below.

Benefits – Cryptocurrencies make it easier for two parties to transfer funds quickly without the need to involve a third party like a credit card company or a bank. These funds are protected by public and private keys and other mechanisms like proof of stake and proof of work.

A cryptocurrency user normally has a wallet to store their digital coins in. This wallet has a public key and a private key (known only to the owner of the wallet) used to approve and authorise transactions. The fee charged when transferring funds is smaller than what a regular bank will charge its customers.

Shortcomings – Because cryptocurrencies are semi-anonymous, they are sometimes used for illegal transactions, such as tax evasion and money laundering. While cryptocurrencies are often touted for their potential to offer privacy and protection against government repression, the degree of anonymity they provide differs significantly among various coins.

For example, Bitcoin is not the smartest choice for illegal activities due to the design of its ecosystem, which enables authorities to track transactions. While coins like Monero and shielded Zcash employ strong cryptographic techniques that make tracing transactions significantly more difficult, achieving absolute untraceability remains a challenge.

| Benefits | Shortcomings |

|---|---|

| Easy to transfer funds directly between two parties | Some crypto networks are used for illegal transactions. |

| Transactions are secure. | Crypto funds can be easily lost forever if the crypto wallet’s password is forgotten. |

| Transaction fees are relatively small. |

What is a cryptocurrency wallet, and what are the types?

Unlike a traditional bank account which holds your funds, a cryptocurrency wallet is a digital tool that stores your private keys, enabling you to access and manage your cryptocurrency on the blockchain. To manage your crypto, you must set up a digital wallet. It securely stores your private keys, which are essential for accessing, managing, and authorizing transactions with your cryptocurrency on the blockchain.

With a wallet, you will be able to send and receive crypto and even use it to pay for goods or services. You typically use a password or PIN to access your wallet interface, while your private keys are used to authorize transactions.

Wallets exist in different forms — from mobile wallets which you can use to shop online (similar to how you might use a payment app) to hardware wallets that you can physically keep, like a secure device.

How do crypto wallets work?

Crypto wallets are fundamentally different from your physical wallet because, instead of storing money, they store private and public keys. The public keys are like your bank account number, while the private keys are like the PIN you use to authorize transactions from your account.

When you send some coins to someone’s wallet address, you are transferring the ownership of those coins on the blockchain to the recipient. So, for the recipient to spend the newly transferred coins, their private keys must match the public address where the coins were sent.

Thus, ownership of the private keys gives one total control over the funds associated with the corresponding public address. For this reason, it is vital to keep your private keys safe so that ONLY YOU know what they are. If another person gets hold of your private keys, they can steal your coins by sending them to another wallet address that they control.

You should also back up your private keys to prevent accidental loss, as you would lose your funds if you cannot recover them. There have been cases of investors losing millions of dollars as a result of losing their private keys.

Types of Crypto Wallets

There are many types of crypto wallets. Each type operates differently, with its own advantages and disadvantages. Below are some of the main ones you can choose from.

Online wallets – Online wallets are wallets that are connected to the Internet and stored on a server. You can access your crypto from any device through a web browser as long as you are connected to the internet. However, their security can be compromised if the online platform is breached or if your account is not adequately secured.

Desktop wallets – Desktop wallets are software applications installed on a computer, offering the benefit of local key storage. However, their security depends on the security of the computer itself and its vulnerability to malware or unauthorized access.

Mobile wallets – Mobile wallets offer a convenient way to access your crypto via a smartphone app. While they store private keys locally on the device, their security can be compromised by malware or if the device is lost or stolen.

Hardware wallets – A hardware wallet is a physical device where you can keep your private keys offline. You can link it with your computer through its USB port to conduct transactions. It is generally considered more secure than other types of wallets described above, especially for storing larger amounts of cryptocurrency. However, this type of crypto wallet tends to be more expensive, requiring the purchase of a hardware device.

Paper wallets – A paper wallet involves storing your public and private keys printed on a physical piece of paper. While it can be a secure method for long-term storage due to its offline nature, it is inconvenient for regular use and vulnerable to physical damage or loss.

Custodial wallets: A custodial wallet involves a third party, such as a cryptocurrency exchange or another service provider, holding and managing your private keys on your behalf. This offers convenience but means you entrust the security of your crypto to that third party.

Non-custodial wallets: A non-custodial wallet puts you in complete control of your private keys. You are solely responsible for their security and backup. This provides greater autonomy and reduces reliance on a third party, but also places the full responsibility of security on you.

Note that cryptocurrency wallets are typically designed to support specific blockchains and their native coins or tokens. Sending a cryptocurrency to a wallet that does not support that particular asset can result in the funds not being displayed and potentially being difficult or impossible to recover without advanced technical knowledge and access to the private keys.

| Wallet | How to access it | How secure |

|---|---|---|

| Online wallet | Third-party online servers | Somewhat secure |

| Desktop wallet | Software installed on PC | Quite secure |

| Mobile wallet | Wallet app on mobile device | More secure than online wallets |

| Hardware wallet | Physical USB-like device | Very secure |

| Paper wallet | QR-code or keys printed on a paper | Very secure but outdated |

Cryptocurrency trading vs. investing: which is better?

As you start your crypto trading journey, you have to be certain of your goals — whether you want some short-term gains or you want to hold your assets for a long time.

Cryptocurrency trading means speculating on the short-term price movements of crypto coins either by directly buying and selling the coins on a crypto exchange or by trading contracts for difference (CFDs) with a broker.

CFDs enable you to speculate on the short-term price movements in the cryptocurrency market without having to own the underlying asset. You can go long or short and use leverage – that is, you do not need to have the full face value of the asset before you can trade it. You only need to have the required fraction of the face value known as margin to trade the asset. However, you should know that leverage can amplify both your profit and loss; so, depending on whether the market moves in favor of your trade or against your position, it can be a blessing or a curse.

A common investment strategy in cryptocurrencies is to hold assets for a long term, sometimes for many years or indefinitely (popularly known as “HODLing”). Investing is more like the buy-and-hold method with stocks. A crypto investor buys a coin they believe would grow in the future and hold it for many years or forever, only selling piece by piece when they need money.

Both trading and investing have their benefits. It all depends on your goals and risk appetite. If you have a high tolerance to risk, you might decide to trade, but if you are a more conservative person, you may decide to buy and hold.

| Trading | Investing |

|---|---|

| Short term | Long term (HODL) |

| For those with a high risk tolerance | For conservatives |

| Directly with the coins or indirectly via CFDs | Directly with the coins |

| Can use leverage to increase potential profits | Not available |

Crypto Trading Profit Calculator

Coins Purchased: 0

Final Value ( USD ): 0

Profit / Loss ( USD ): 0

Crypto market versus the stock market

Now, let’s compare the cryptocurrency market to the stock market.

How is the crypto market similar to the stock market?

While the cryptocurrency market and the stock market are very different in many ways, there are a few things they have in common. First, both are considered security markets by tax authorities, and profits made from trading or investing in them are taxable based on the duration of the trades. Keep in mind that tax policies concerning profits from cryptocurrency trading and investments differ depending on where you live.

Second, investing and trading strategies are more or less the same for both markets. Cryptocurrency traders can choose to scalp, day-trade, or swing-trade, while crypto investors can buy and hold their assets as they would normally do in the stock market – for the long term.

Third, the analytical tools used for trading in the cryptocurrency market are similar to those employed in stock markets. Both utilize charts for analysis, and technical indicators (which we will cover later in this guide) can be applied to interpret them.

Fourth, although the cryptocurrency market is nascent and still developing (unlike the stock market that has been there for centuries), it also has many derivative products, such as futures and options. Moreover, just as the stock market is valued in fiat currencies, the crypto market also has its value pegged against fiat currencies.

| Crypto Market | Stock Market | |

|---|---|---|

| Taxable security | ||

| Short-term trading and long-term investing | ||

| Technical analysis tools used | ||

| Derivative products |

The difference between the cryptocurrency market and the stock market

Despite the similarities between the two markets, they are very different. Succeeding in one doesn’t mean you can trade the other. Here are the key areas where they differ.

Volatility – The cryptocurrency market is highly volatile and exhibits massive price swings. It is not uncommon to see a double-digit percentage change in crypto within a short time. The stock market, on the other hand, is less volatile and more stable.

Market securities or assets – In the stock market, you purchase shares representing ownership in publicly listed companies. In contrast, the cryptocurrency market involves buying or investing in digital currencies or the underlying technology and concepts, rather than shares of a company.

Regulations – The stock market benefits from decades of regulatory scrutiny and understanding, resulting in established rules and guidelines for its operation. In contrast, the cryptocurrency market, being less than two decades old, presents ongoing challenges for regulators. The lack of comprehensive and definitive regulation contributes to the market’s persistent volatility and limited oversight.

Market maturity – Age is very important in the financial market. The stock market has been active for many centuries, while the cryptocurrency market is still in its second decade. Trading volume and market value in the stock market are far larger than that of the crypto market. The young age of cryptocurrencies is one of the contributing factors to its wide volatility.

| Crypto Market | Stock Market | |

|---|---|---|

| Volatility | Very high | Normal |

| Assets | Crypto coins, tokens, and technology | Shares of companies |

| Regulations | Poor | Adequate |

| Maturity | About a decade | Many centuries |

Various cryptocurrency markets

There are two categories to trade in the cryptocurrency market: the spot market and the derivatives market.

Crypto spot market

In the cryptocurrency spot market, coins or tokens are bought or sold for immediate delivery. When you trade in the spot market, you own the assets. This means that you can profit only when the value of the underlying asset in your portfolio rises.

For example, if you buy 1 BTC (equivalent to $92,471 at the moment), you must pay the face value, in this case, $92,471. You will have 1 BTC in your wallet: if the price rises and you sell the coin, you profit, but incur losses if it falls.

The spot market is made up of two types of traders: makers and takers.

The spot market operates with two key participants: makers and takers. A maker is a trader who adds liquidity to the market by placing a limit order that is not immediately filled. For instance, if a trader wants to sell a coin at a specific price slightly above the current market value, this sell limit order will remain in the order book until a buyer is willing to meet that price, thus “making” a new price point and adding to market depth.

Conversely, a taker is a trader who removes liquidity from the market by placing a market order that is executed immediately at the best available price listed in the order book. Whether buying or selling, if you choose the fastest execution at the current market price, you are “taking” away from existing liquidity. Therefore, both buyers and sellers can act as makers by setting limit orders, and both can act as takers by executing market orders. Makers provide liquidity, allowing for smoother trading, while takers consume that available liquidity to execute their trades. It is for this reason that makers incur lower crypto exchange fees than takers.

Crypto derivatives market

Cryptocurrency derivatives are financial contracts that track the value of an underlying asset. They can also derive their value from other derivatives.

Derivatives consist of contracts of multiple parties with the contracts getting their price from already existing assets like Bitcoin, ADA, Dent, and others.

There are many forms of derivatives in the crypto market. Some of them include leveraged tokens, futures contracts, options contracts, and contracts for difference (CFDs). Given their leveraged nature and complexity, cryptocurrency derivatives typically carry considerably higher risks than spot market trading and are therefore more suitable for experienced traders.

| Crypto spot market | Crypto derivatives market |

|---|---|

| You own the asset | May not own the asset in most situations |

| Traded at face value | Traded on margin |

| Leverage unlikely | Leverage is available |

The bid-ask spread

The bid-ask spread is the difference between the highest buy (bid) price and the lowest sell (ask) price for any market. This difference shows you the lowest price a seller is willing to take and the highest price a buyer is willing to offer. In terms of the order book, the bid-ask spread represents the gap between the highest buy limit order and the lowest sell limit order.

The width of the spread is used to measure how liquid the market is. The narrower the spread, the higher the liquidity in the market. It is also used to measure the supply and demand of a security where supply is represented by the sell-side and demand by the buy-side.

Common chart types

A chart is a graphical representation of data — in this case, price — over time. There are so many types of charts you can use to analyze the cryptocurrency market, but the most popular ones are the Japanese Candlestick, the bar chart, and the line chart. Others include the point and figure chart, Renko chart, and so on. But we will focus on the three most popular types in this section.

Candlestick chart

The Japanese candlestick chart graphically represents the price movements in a trading session as a candlestick, with upper and lower wicks and a body depending on the price action for that period. Each candlestick represents a price at a specific timeframe. For instance, a 10-minute candlestick chart will show candles that represent 10-minute trading sessions each, while a 1-hour chart will show the price action of a 1-hour trading session per candlestick.

A Japanese candlestick has four data points: the opening price, lowest price, highest price, and closing price. The opening price is the initial price within a specific trading session (timeframe), and the closing price is the final price before the current candlestick closes and the next candlestick starts to develop.

One interesting thing about the candlestick chart is that it can be color-coded to show how the trading session closed (bullish or bearish), and you can customize it with colors you like. However, the most common colors traders use are green or white for bullish candlesticks and red or black for bearish ones. The wicks (or shadows) are the thin lines extending above and below the candlestick’s body, indicating the price extremes reached during the trading session relative to the open and close prices.

Bar chart

A bar chart is the graphical representation of price fluctuations, with price bars being the main tool used in this type of chart. Each bar shows the price action for a particular timeframe. A bar chart consists of a vertical line that shows the lowest and highest price for a given period plus side marks that indicate the open and close prices. Just like the Japanese candlestick, a 10-minute bar chart shows the price action for every ten minutes. It also consists of four data points representing the open, high, low, and close.

Line chart

A line chart represents a security’s price by using a single, continuous line. Most often, the closing prices of the trading sessions are used to plot the line chart but any other price point — open, high, or low — can be used. By displaying only the closing price, the line chart can make it easier to identify trends compared to analyzing the open, high, and low prices. It is best used to look at the general movement of the market (trend).

Comparing the three common chart patterns

| Candlestick Chart | Bar Chart | Line Chart | |

|---|---|---|---|

| Shows individual trading sessions | Yes | Yes | No (it is a continuous line) |

| Color-coded | Yes | Yes | No |

| Price points shown | 4 (open, low, high, and close) | 4 (open, low, high, and close) | 1 (mostly close but can be any of the 4 price points) |

Why trade cryptocurrencies?

Despite the negative publicity the cryptocurrency market has attracted since its emergence, many people still trade crypto. What draws people to the cryptocurrency market? Well, here are some reasons you may want to try out the market.

Round-the-clock access – Unlike the stock market, which has set weekday trading sessions, the decentralized nature of cryptocurrency exchanges allows for continuous trading, 24 hours a day, 7 days a week. This constant availability enables traders to operate at their convenience and even employ trading algorithms for automated, round-the-clock market activity.

Easy to open an account – Opening a cryptocurrency trading account can often be a simpler process compared to traditional stock brokerage accounts. While some exchanges may initially only require an email address for signup, Know Your Customer (KYC) verification, involving the submission of identification documents, is frequently mandated depending on your jurisdiction and the exchange’s policies, especially for accessing the full trading features of the exchange and enjoying higher withdrawal limits.

Wide varieties of assets to trade – The cryptocurrency market has developed a lot, despite its relatively young age. Most financial instruments found in the stock market can now be traded in the cryptocurrency market. Some of these products include leveraged tokens, options, futures, CFDs (Contract for Difference), and swaps. Any kind of derivative you are looking to trade is available in the cryptocurrency market.

Market volatility – The volatility in the cryptocurrency market can be seen as a positive thing for traders. Let’s ignore the negatives for now; the cryptocurrency market can produce quick gains. An increase in volatility means more trading opportunities for you.

There’s some degree of privacy and anonymity – If you value privacy, then the cryptocurrency market is your best bet. Unlike stock trading that involves opening an account with your documents, some crypto exchanges do not store your data or have access to your crypto. However, there are some centralized exchanges where you will be required to drop some details about yourself.

Cryptocurrency trading techniques

There are two primary methods to analyze and trade the financial markets. These methods have existed for a very long time and have also been integrated into the cryptocurrency market. They are fundamental analysis (FA) and technical analysis (TA). You can use each of these techniques independently but most traders use them together.

Understanding fundamental analysis (or FA)

Fundamental analysis is the technique of using financial and economic factors that directly affect a security to forecast its future value. FA helps you to ascertain whether an asset is overvalued or undervalued at the current market price. If you can figure this out, then you can decide whether to invest in it or not or how long you would like to hold the asset if you already own it.

Using FA for cryptocurrency trading involves looking at two significant factors — the on-chain and off-chain metrics. On-chain metrics include wallet addresses (both active and inactive), network fees, network hash rate, and transactions, and token issuance rate.

These on-chain metrics may seem too much of a burden to find. But thanks to websites like Bitinfocharts.com, you can easily find this information, and it is simple and easy to analyse.

On the other hand, off-chain metrics are just about exchange listings, community engagement, and government regulations, the technology, and the cryptocurrency’s intended purpose and potential for adoption.

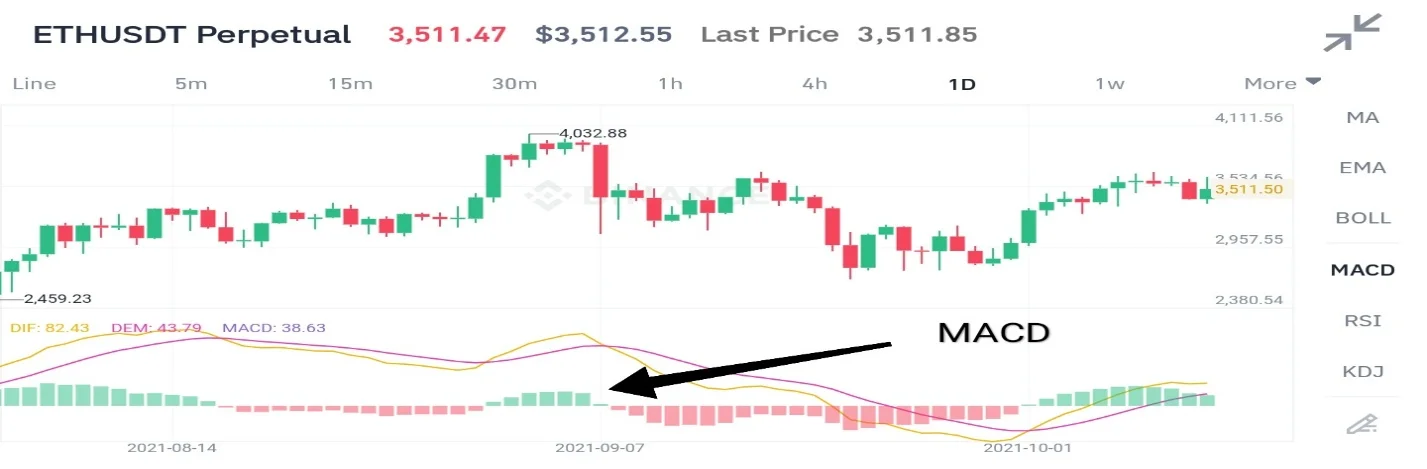

Understanding technical analysis (or TA)

Technical analysis is a trading technique whereby traders use charting software and trading indicators to study historical price action and patterns so as to predict the possible price movements in the future. Some of the indicators used include moving averages, MACD (Moving Average Convergence Divergence), and RSI (Relative Strength Index). Other tools used include candlestick patterns, chart patterns, support and resistance, trend lines, and Fibonacci levels.

You can use technical analysis to trade on any timeframe and employ any style, from scalping to long-term trading. The key thing traders look out for is the condition of the market: is it trending or range-bound?

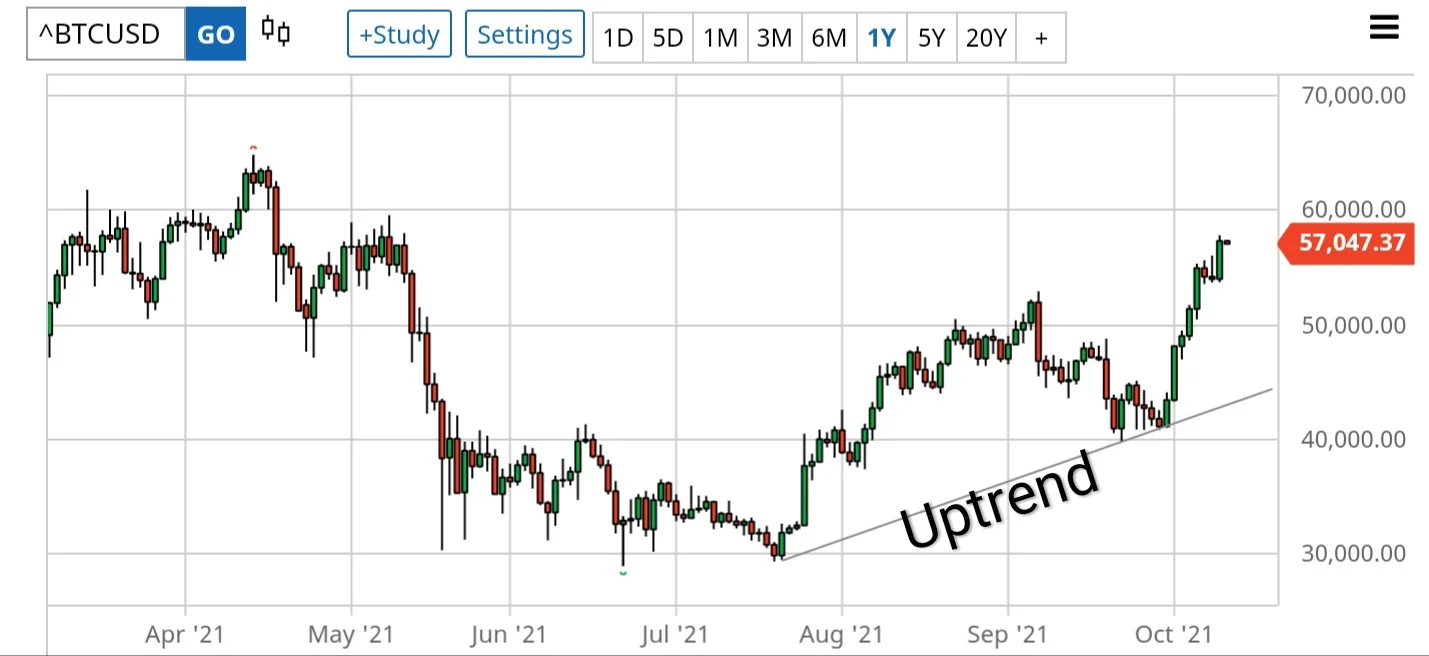

A trending market

A trending market has an overall upward or downward tendency. You can spot the trend from the nature of the price action, but many traders use moving averages and trend lines to delineate it.

Generally, market trends are divided into two types: a bull market and a bear market. A bull market is a market that is in an uptrend (the general market direction is upwards), while a bear market is one in a downtrend (prices are declining).

Another thing to note is that the market does not move in a straight line. It is normal for the market to show a temporary decline during an uptrend and also rally for a brief period during a downtrend. However, the timeframe you look at also matters because you can have an uptrend in an hourly timeframe while that same asset might be in a downtrend when considering the daily timeframe. Trends on the higher timeframe are more important than those of the lower timeframe.

Range-bound market

A market is described as range-bound if it is moving sideways. That is, there seems to be no clear market direction; the market is neither in an uptrend nor in a downtrend. This type of market can also be called a trendless, horizontal, or ranging market.

The market just swings up and down within a range. The upper border of the range acts as a resistance zone as the price finds it difficult to convincingly climb above it. Likewise, the lower border of the range acts as a support area with the price failing to break below it.

Common technical analysis tools and indicators

Technical indicators are mathematical calculations based on market data. This data can be on-chain data, volume, price, volatility, and open interest amongst others. Technical indicators may be described as leading or lagging the price.

While most technical indicators are based on price data, some are considering the trading volume of the asset. Examples include on-balance volume, open interest, accumulation and distribution, etc.

Price-based indicators can be grouped into trend indicators (moving averages and average directional indices) and oscillators (CCI, RSI, and Stochastic, etc.), and momentum indicators, such as the MACD.

Trend lines

Trend lines are a popular tool used by traders and chartists. They are diagonal lines drawn on the charts to connect price points. However, some traders do draw them on other technical indicators.

The primary purpose of this instrument is to determine the trend in the market and and to understand its structure better. It can also be used to identify dynamic support and resistance levels. Trend lines can be applied to any timeframe. However, trend lines on higher timeframes are more reliable than lower timeframes. Also, a trend line is considered valid only if the price touches it at least twice, otherwise, it is considered unreliable.

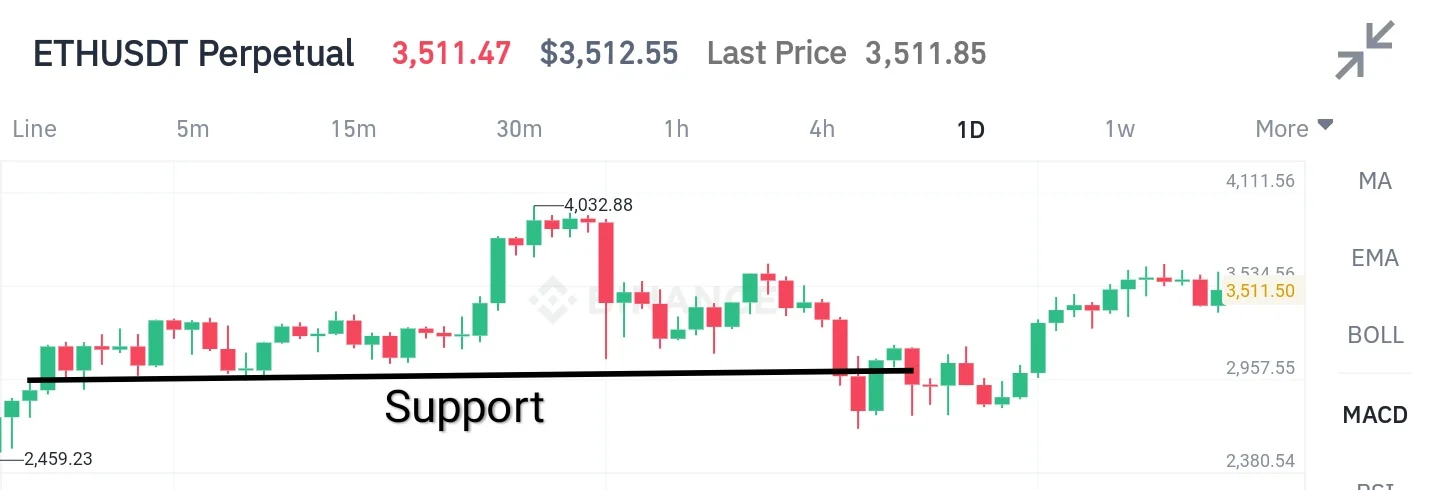

Support and resistance levels

Support and resistance are very important concepts in technical analysis. The support level acts as the floor from where the price bounces upward. That is, it is an area of increased demand where bidders (buyers) get in and push prices up.

A resistance level, on the other hand, is the price ceiling. It is an area where there is a large amount of supply, which causes the price to decline due to increased selling pressure.

To put it shortly, support is a level of increased demand while resistance is a level of increased supply. However, there are other factors that contribute. In the chart above, notice that when the price broke above the resistance level that level started acting as a support level.

Apart from drawing the trend lines and horizontal lines for support and resistance, traders also use technical indicators in their analysis. Let’s take a look at the most commonly used indicators.

Moving averages

Moving averages are technical indicators used to smooth price action and identify market trends. The moving average is a lagging indicator because it relies on historical prices.

There are different types of moving averages; the two most popular ones are the SMA (Simple Moving Average) or EMA (Exponential Moving Average). While both of these smoothen prices, they differ in the way they are calculated.

The SMA is calculated using previous price data from n’ periods and then creating an average from it. As an example, the 100-day SMA takes the mean price of the last 100 days and then represents it as a line on the graph.

The EMA, on the other hand, puts more weight on recent price data. As a result, it reacts faster to price action than the SMA.

Moving averages are a great tool to use in your trading, but as with most indicators, they should never be used alone because of their lagging behavior. Pairing it with another indicator will give you a higher probability of success in your trades.

Oscillators

Oscillators are technical indicators that oscillate about a central line or within the upper and lower limits of the indicator box. Oscillators are used to identify when a particular asset is overbought or oversold. Technically speaking, when the indicator enters the upper extreme band, the asset can be said to be in the overbought region, and if it is in the lower extreme band – it is oversold.

Examples of oscillator indicators include the Relative Strength Index, the Williams %R, Stochastic, CCI (Commodity Channel Index), Momentum, and the MACD.

FA vs. TA – which is better for trading?

Whether or not you use fundamental or technical analysis depends on your trading preferences. If you are the kind of trader that would normally enter and exit positions rapidly within a day, then using technical analysis will be your go-to approach, but that does not mean that you cannot trade based on news events. On the other hand, if you prefer to do your research and make trading decisions based on core information about an asset, then fundamental analysis is a good choice.

| Fundamental Analysis | Technical Analysis |

|---|---|

| Considers economic and other factors to estimate the present and future worth of the asset | Uses previous price action to forecast future price movements |

| Suitable for ascertaining the long-term outlook of the asset | Mostly focused on short-term and medium-term price movements |

| Requires deliberate research into the factors that can affect the asset | Focuses on the market data (mostly price and volume) |

| Used for gauging the long-term direction of the market | Used for timing entry and exits |

Using the two approaches may be more helpful than relying on one. As a cryptocurrency trader, you can never have enough tools in your trading arsenal. Integrating both FA and TA into your trades will give you a higher chance of spotting trading opportunities in the crypto market. This is because the two complement each other.

Let’s take a look at a practical scenario. You can use FA to determine the overall direction of the market over the long term. But there is not much help in deciding when to invest using this information. This is where TA comes in; you can use TA to time your entry and determine your exit.

Additionally, when you want to invest in an asset using TA, you can use FA to determine if the direction you are taking is in line with the market’s long-term outlook. As you can see, it is important to use both techniques rather than relying only on one of them.

Types of trading orders

To buy or sell crypto, you have to instruct the exchange how to execute your orders. For immediate buying and selling, you might place a market order but sometimes you may want to trade at a particular price level. Below are some of the common types of orders in trading.

- What is a market order? – A market order is an order to buy or sell a security at the best available market price. Market orders are executed at the current market price regardless of whether it has decreased or increased. While this type of order can get you in at a worse price, it is executed immediately.

- What is a limit order? – This is a buy or sell order executed at a specified price level or a better one. A limit buy order must be placed below the current market price for it to be valid, and the order is executed at the specified level or below it. Likewise, a limit sell order is placed above the current market price, and the order is executed at the specified price level or above it. For example, you can place a limit buy order if you expect the price to decline after a rally before continuing the rally. Let’s say BTC is trading at around $92,000, you may decide to place a limit buy order at $91,000 if you think it is a support level. When the market declines to $91,000 or lower, your order will be filled but never higher than your limit order. A major drawback to this form of crypto trading is that the market may not come down to hit your order or it might take a longer time to execute. Limit orders are a great way of taking advantage of buying at a lower price than what the market is offering. But you must understand how it works before using it properly.

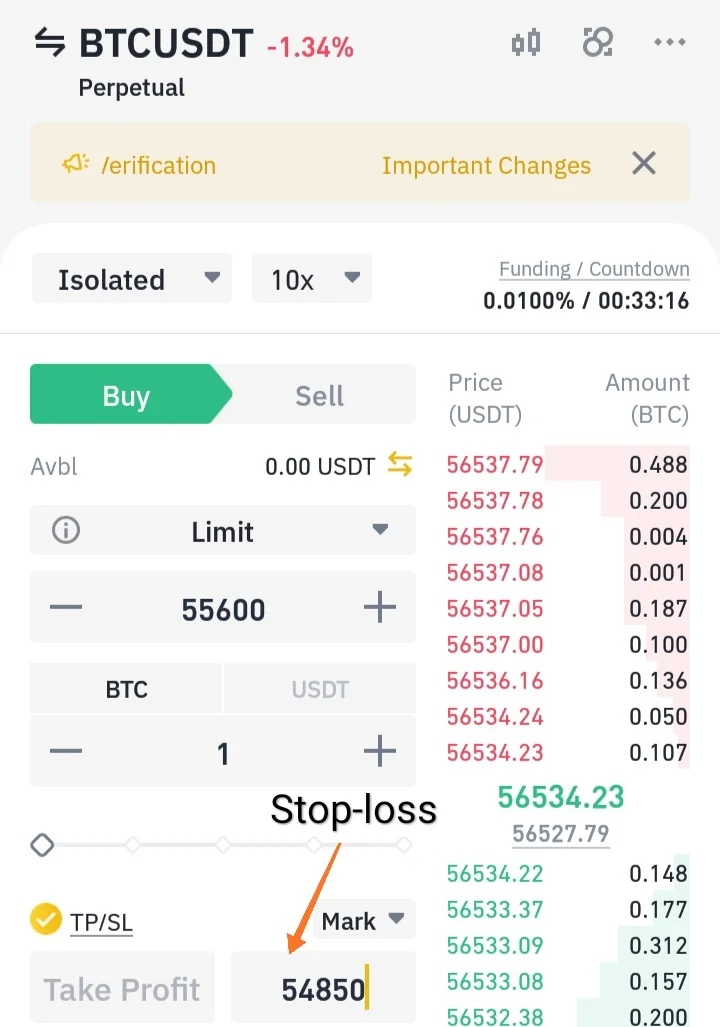

- What is a stop-loss order? – A stop-loss order is an order to exit a position if the market moves against you up to a certain level. The idea behind a stop-loss order is to limit losses. As a trader, you must have an invalidation point where you accept that your prediction is wrong. When your stop-loss order is triggered and executed, your trades are closed and you incur a small loss that you already planned to take. See the example below. An order to buy 1 Bitcoin at $55,600 was placed and below the limit price, you can see another price as $54,850. That is a stop-loss order telling the market that after executing the limit order, if prices go below our entry point, it should close the trade at $54,850. Using a stop-loss order allows you to avoid a catastrophic loss or a complete liquidation of your trading account.

Note that a stop-loss order is not fool-proof. In certain conditions where the price gaps below your stop-loss order, it will not be triggered. Nonetheless, it is always better to set it, but you should always monitor your trades and also keep your position size small to mitigate losses.

Note that a stop-loss order is not fool-proof. In certain conditions where the price gaps below your stop-loss order, it will not be triggered. Nonetheless, it is always better to set it, but you should always monitor your trades and also keep your position size small to mitigate losses.

Knowing when to buy and sell

Knowing when to buy or sell is not an easy skill to acquire but the key thing is to have your entry and exit criteria. For example, you might decide to buy when the market is oversold and sell when the market is overbought based on a 14-period RSI indicator.

But it is not enough to have a trading strategy with entry and exit rules. You should also have a trading plan.

Why do you need a trading plan?

Having a trading plan will go a long way to ensure you do the right thing at all times, staying in line with your goal. Without a trading plan, you will be buying and selling without knowing what you hope to achieve. A trading plan is like having a map; it is your guide in your cryptocurrency trading journey.

Your trading plan helps to keep your emotions in check. As you may know, one of the greatest challenges traders face is how to deal with their emotions. This is even more serious when the price starts going against your position or you experience multiple losing streaks. Sticking to your trading plan will enable you to avoid irrational trading decisions.

A trading plan also requires a money and risk management strategy. These are essential for succeeding in trading, as they help you to preserve your account long enough to start making profits.

Different styles of trading

Crypto traders adopt different styles of trading — scalping, day trading, swing trading, and position trading. The right style for you depends on your personality, risk tolerance, and how busy your schedule is. For example, you might be someone who works 9 to 5, lacking the time to monitor the market continually.

Now, let’s take a look at those trading styles:

Scalping

Scalping is an intraday trading strategy whereby a trader profits from small price changes over a very short time — from seconds to some minutes. This strategy involves constant monitoring of charts on the lowest timeframes, quick timing, and precise entry and exit.

Trades can run from a few to hundreds per day when scalping. In fact, most scalpers these days rely on trading algorithms.

Day trading

A day trading strategy involves entering and exiting positions within the same day. It involves holding positions for several minutes to a few hours, and a few trades can be made before the end of the day.

If you have a busy schedule, day trading might not be for you because it requires monitoring the markets all day.

Due to the volatility of the cryptocurrency markets, day trading might not be a suitable style for beginners. A day trader must have strong discipline and the ability to keep emotions out of their trades.

Since it involves having multiple trades open, an electronic trading system might be adopted to help filter misjudgements resulting from human emotions. If you are a risk-averse trader, you should consider using a more conservative approach.

Swing trading

Swing trading is an approach that involves holding a position from a few days to a few weeks. The aim is to capture the individual price swings on the daily timeframe, so the trades are mostly done on that timeframe, though a swing trader can step down to the 4-hour timeframe to get a better entry.

Swing trading is a more conservative approach since positions are held for a few days to few weeks, and the trader does not need to constantly monitor the market. It also allows the trader to catch larger market moves compared to day trading and scalping.

Position trading (HODL)

Position trading is a long-term trading strategy. It is also known as a trend-following strategy. It involves spotting trends and placing your orders in the direction of those trends. Typically, trades are held for months and sometimes for years until a trend reversal occurs. Both swing and position trading are more suitable strategies for beginners, with day trading falling more into the category of strategies for advanced trading.

| Scalping | Day Trading | Swing Trading | Position Trading | |

|---|---|---|---|---|

| Trade duration | Some seconds to a few minutes | Some minutes to a few hours | Days to weeks | Months to years |

| What traders are called | Scalpers | Day traders | Swing traders | Position traders |

| Timeframe | Tick chart, 1-minute, and 5-minute timeframes | 5-minute to hourly timeframe | Daily timeframe and sometimes, 4-hourly timeframe | Weekly timeframe and daily timeframe |

| Time requirement | Time-consuming | Time-consuming | Less time consuming | Least time consuming |

| Approach | Part-time or full-time | Full-time | Part-time | Part-time |

Margin trading (trading with leverage)

Margin trading is a situation where a broker or an exchange allows you to open a position with only a fraction of its total worth. This means that you are trading with leverage where you borrow additional capital from the broker or exchange to gain greater market exposure. This has both positives and negatives.

When using leverage in trading, your gains and losses are amplified. Many exchanges offer different degrees of leverage like 1:10, 1:50, 1:100, etc. Beginner traders should understand how leverage works before opting to use it.

Risk management

The cryptocurrency market is riskier than any other market due to its nature. Cryptos have been known to make double-digit percentage moves within a day, thus, proper risk management must be adopted to preserve capital. How and when you should buy assets should be considered. Also, the amount of capital to be dedicated to an asset must be pre-set before executing any trade.

Managing your portfolio

Portfolio management is very important in crypto trading. This will indicate how well you allocate capital across all the assets that you hold. Before creating a portfolio of cryptocurrency investments, you should plan what you expect from a particular asset over the short and long term.

Managing your portfolio properly will ensure you get consistent returns from your investment by adding high-performing assets and removing underperforming ones.

How to pick the best cryptocurrency exchange

There are many exchanges out there for you to trade your cryptocurrencies on. While some are good, there are still some bad eggs among them. Below are some things to look out for before choosing a cryptocurrency exchange.

Liquidity – An exchange with high liquidity means that trades will be executed quickly, and traders can easily withdraw money at any time. A high-liquidity exchange is unlikely to be a ground for market manipulation, as its high trading volumes make it reliable to work with.

Security – Security should be your top priority when choosing an exchange. Some cryptocurrency exchanges have been victims of hacks where tokens worth hundreds of millions of dollars were stolen. The most recent example comes from February 2025, when major exchange Bybit experienced a significant security breach resulting in the theft of approximately $1.4 to $1.5 billion in Ethereum tokens. Ensure the exchange uses the best technology to secure their website and protect customers’ data.

Transaction fees – Understanding an exchange’s fee structure is crucial because it can significantly influence the type of trading strategies you can profitably employ. If you are a scalper or a day trader, for example, you will pay more fees because of your increased trade frequency.

Your profit margin is impacted by fees. Low fees can lead to substantial profits, while high fees can significantly erode or even completely eliminate your gains.

Payment and withdrawal methods – The ease of depositing and withdrawing funds should be considered before choosing an exchange. An exchange with multiple payment options like credit cards, cryptocurrencies, and PayPal enables easier transactions for different traders.

User experience – The user interface should be easy to navigate especially for newbies. That includes how easy one can place their “buy” and “sell” orders in the exchange platform’s order book.

Recommended platforms for your first trades

If you are a beginner looking for an exchange that is easy to navigate, then Coinbase is your best choice. Coinbase provides a diverse suite of services beyond basic trading, including a self-custody wallet, staking opportunities, institutional-grade solutions, an NFT marketplace, and educational resources, aiming to serve a wide range of crypto users. Their offerings extend to a debit card for crypto spending and a platform for merchants to accept digital currencies. It also offers a high level of transparency and security.

However, if you want a professional trading experience with more advanced tools and assets to trade, then Binance is the ideal exchange. Binance offers low maker/taker fees and over 500 tradable cryptocurrencies as well as different order types.

Steps to start trading cryptos

If you have made up your mind on trading cryptocurrencies, these are the steps you should follow:

- Raise the capital: You should only commit to trading with money you can afford to lose. Do not invest money needed for living expenses (rent, light and water bills, or emergency funds) since anything can happen and you can quickly lose your entire crypto investment. You can start with small capital to test the waters and get yourself familiar with the market before trading large sums.

- Create a trading plan: Trading without a plan is like sailing without a compass. Create a trading plan suitable for your goals, style, and risk tolerance. It will help you to avoid overtrading and manage your risk accordingly.

- Register with a reliable exchange: Now that you have everything set, you will need to open an account with an exchange and fund it to get started with your first trade. Make sure to do your research and pick a reliable and properly regulated exchange platform.

- Buy your first crypto: It is now time to place your first order. Select your preferred cryptocurrency and start trading. If you have no funds in your account, you can often use a fiat method to instantly purchase the cryptocurrency you prefer to hold or trade.

Conclusion

Trading cryptocurrencies can be rewarding when done properly. Research and continuous learning are necessary for a successful trading career.

Additionally, having other sources of income will help lift the burden of relying totally on trading because the beginning can be tough. We hope that this guide has been of great help.

Note that a stop-loss order is not fool-proof. In certain conditions where the price gaps below your stop-loss order, it will not be triggered. Nonetheless, it is always better to set it, but you should always monitor your trades and also keep your position size small to mitigate losses.

Note that a stop-loss order is not fool-proof. In certain conditions where the price gaps below your stop-loss order, it will not be triggered. Nonetheless, it is always better to set it, but you should always monitor your trades and also keep your position size small to mitigate losses.